inheritance tax calculator colorado

State inheritance tax rates range from 1 up to 16. It is sometimes referred to as a death tax Although states may impose their own estate taxes in the United States this calculator only estimates federal estate taxes Click here to check state-specific laws.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

In Kentucky for instance inheritance tax must be paid on any property in the state even if the heir lives elsewhere.

. Colorado also has no gift tax. Open the FREE inheritance tax calculator. The good news is that Colorado does not have an inheritance tax.

In some states a person who receives an inheritance might have to pay a tax based on the amount he or she. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Enter the value of any life insurance policies that are due to pay out in the event of your death that are not written under trust. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Sales Tax and Sales Tax Rates.

Property Taxes and Property Tax Rates. If the estate was worth 450000 then the first 25000 is exempt. Iowa for instance doesnt.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. Estate tax is a tax on assets typically valued at the. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Colorado charges sales taxes from 29 to 15. Surviving spouses are afforded incredibly strong inheritance rights to intestate estates according to Colorado inheritance laws.

Inheritance taxes are different. In 2021 federal estate tax generally applies to assets over 117 million. To calculate your inheritance tax you need to learn the laws of the state whose laws apply to the estate.

Not the size of the decedents entire estate as a whole. What documents or supporting evidence do you have. IS THERE A INHERITANCE TAX IN COLORADO FROM MY FATHER WHO Lived AND DIED IN Illinois The estimated distribution is around a 140000.

State inheritance tax rates range from 1 up to 16. The siblings who inherit will then pay a 11-16 tax rate. Colorado Inheritance Tax and Gift Tax.

In Iowa siblings will pay a 5 tax on any amount over 0 but not over 12500. Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere. In many states the estate tax ranges from 08 to 16.

The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. If it does its up to that person to pay those taxes not the inheritors. Colorado Income Tax Calculator.

Colorado also has no gift tax. Inheritance tax calculator colorado Friday March 4 2022 Edit. The gas tax in Colorado is 22 cents per gallon of regular gas one of the lowest rates in the US.

The states with the highest estate tax rates are Hawaii and Washington where the tax ranges from 10 to 20. For any amount over 12500 but. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

In fact only six states have state-level inheritance tax. Enter the current value of your home other properties personal possessions savings accounts and investments. Anything else you want the Lawyer to know before I.

There is no inheritance tax in Colorado. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Complete the information in the calculator to see how much your family could be liable to pay in IHT tax to HMRC when you die.

However as of 2021 only six states impose an inheritance tax. Enter the value of any gifts made within the last seven years. Colorado Estate Tax.

Exemption amounts also vary from state to state. If the value of the assets being transferred is higher than the federal estate tax exemption which is 117 million for singles for tax year 2021 and 234 million for married couples the property can be subject to federal estate tax. There is no estate or inheritance tax in Colorado.

As a matter of fact theyre entitled to the whole of the estate if the decedent died without surviving children or parents or all of their children were solely with each other. Federal legislative changes reduced the state death tax credit between 2002 and 2004 and ultimately. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes.

There is no federal inheritance tax but there is a federal estate tax. The tax rate varies depending on the relationship of the heir to the decedent. Instead the states use a progressive tax taking a larger cut of estates that are worth more.

An estate tax is a tax imposed on the total value of a persons estate at the time of their death. Inheritance Tax Calculator Our Inheritance Tax Calculator is designed to work out your potential inheritance tax IHT liability. He had a will the distribution s between me and two sisters.

The District of Columbia moved in the. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. A state inheritance tax was enacted in Colorado in 1927.

Property tax rates are set by each county. Colorado Capital Gains Tax. Inheritance tax rates vary based on a beneficiarys relationship to the decedent and in some jurisdictions the amount inherited.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Surviving spouses are always exempt. First estate taxes are only paid by the estate.

Spouses in Colorado Inheritance Law. Inheritance tax is a tax paid by a beneficiary after receiving inheritance. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

Does Colorado Have An Inheritance Tax.

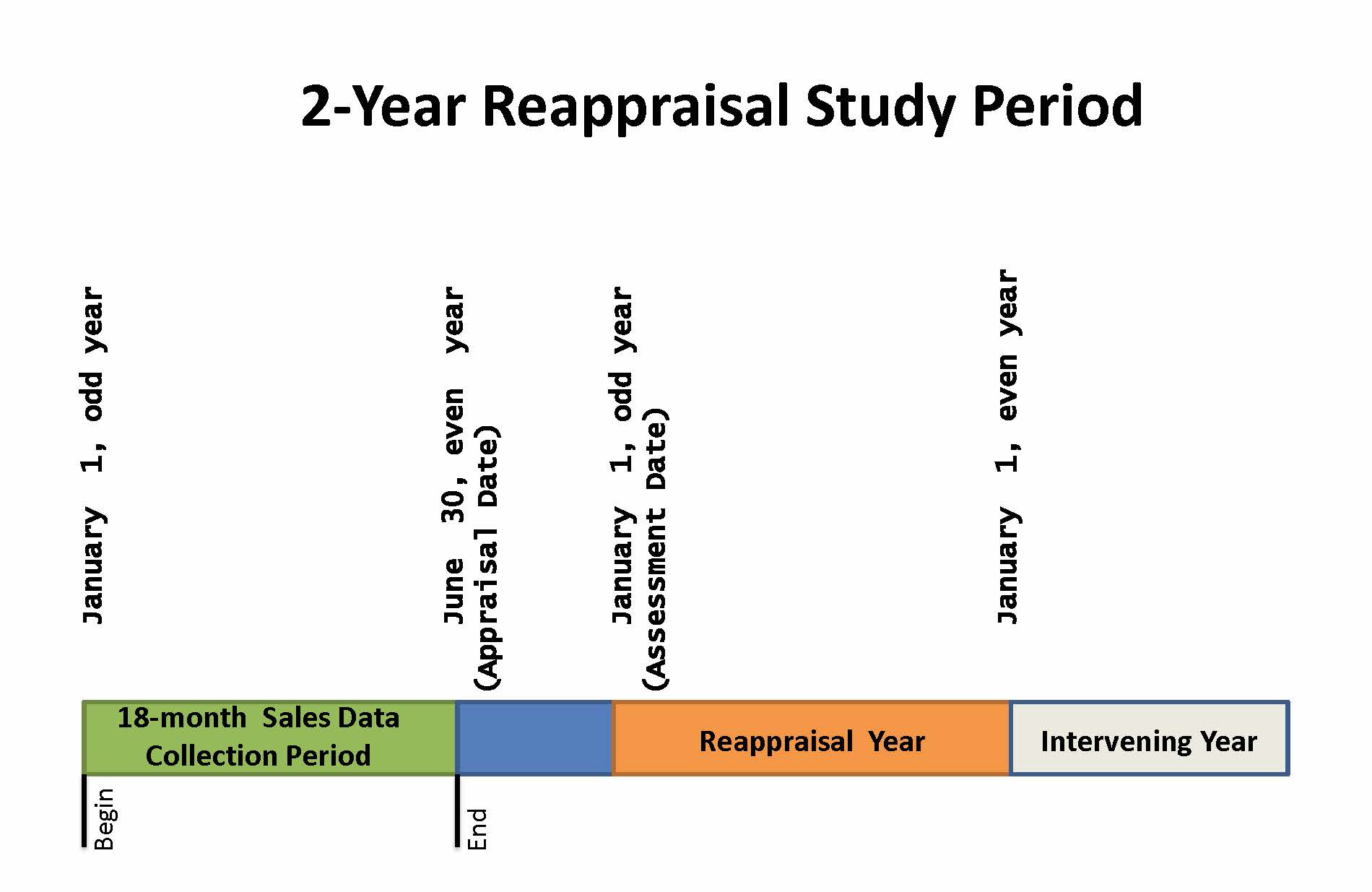

Property Assessment Process Adams County Government

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Individual Income Tax Colorado General Assembly

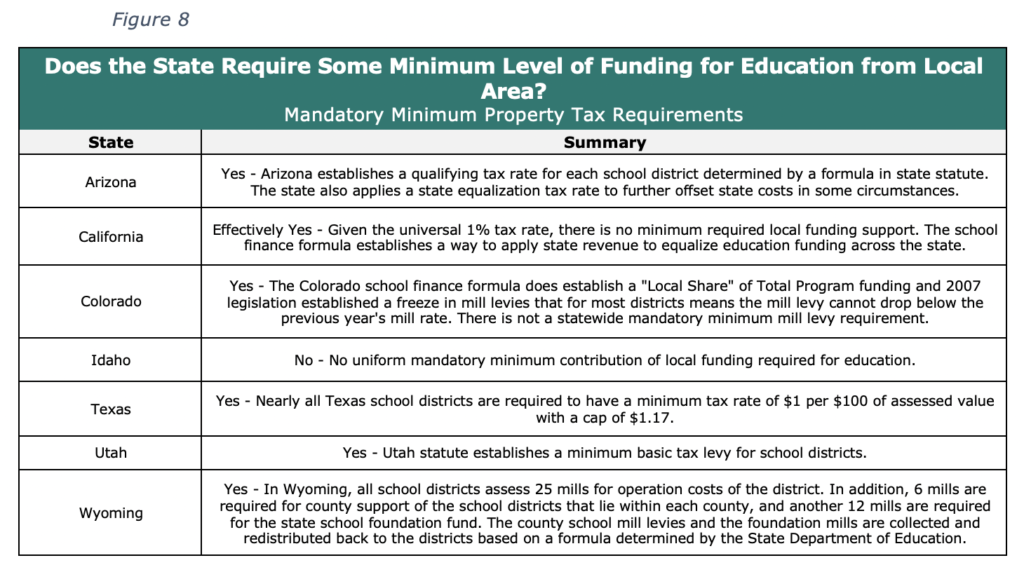

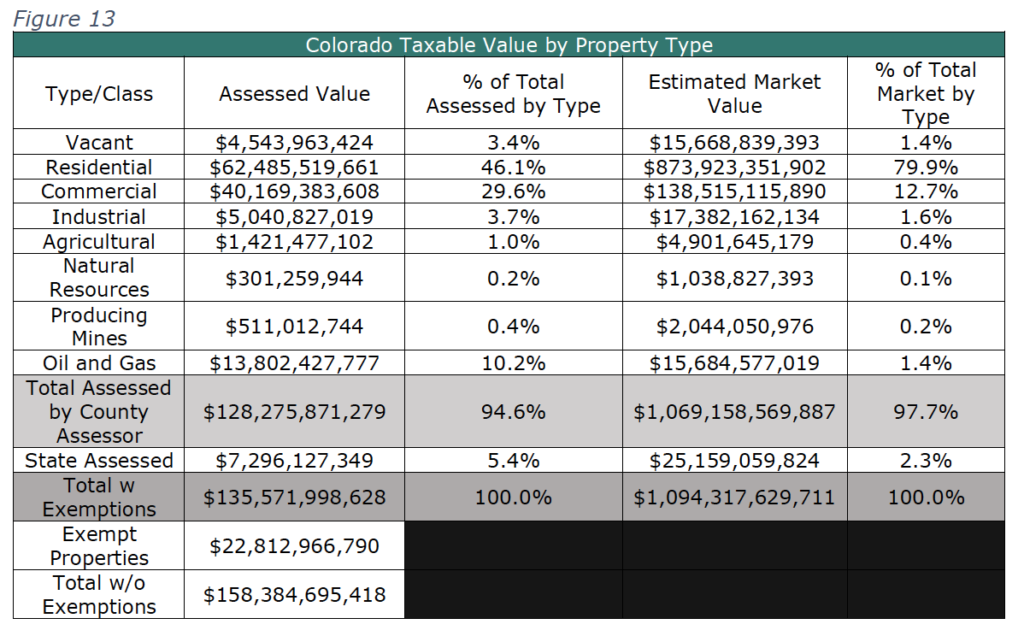

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

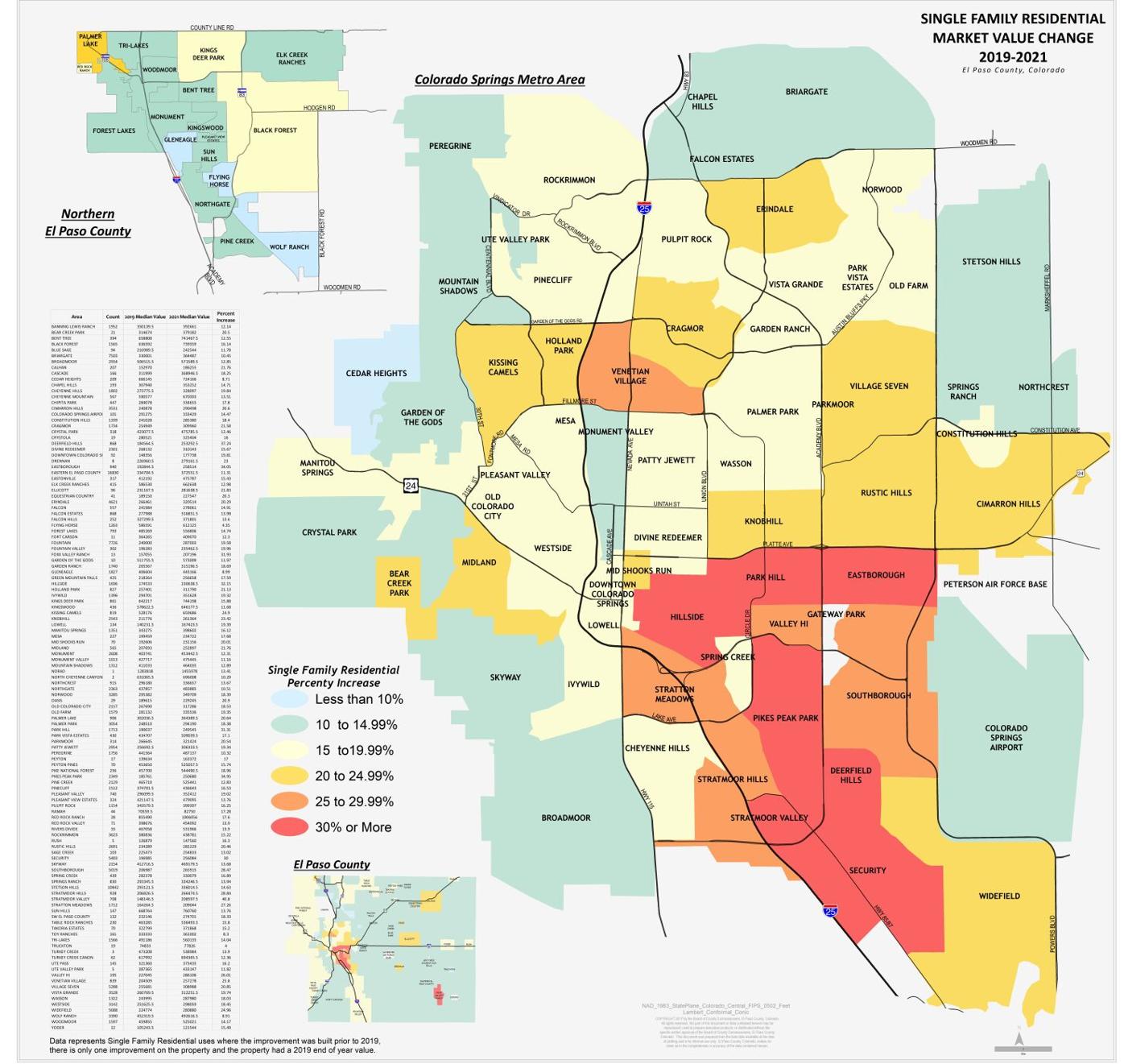

Increased Tax Bills Expected For Most El Paso County Property Owners Assessor Says News Gazette Com

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Property Tax Calculator Smartasset

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

2021 Capital Gains Tax Rates By State Smartasset

Individual Income Tax Colorado General Assembly

Taxation In Castle Pines City Of Castle Pines

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

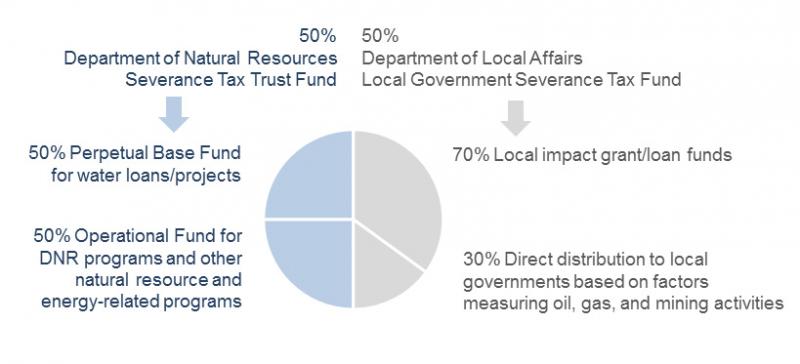

Severance Tax Colorado General Assembly

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute